Top Takeaways

- A new roof can be a big investment, but it doesn’t have to be a financial burden. Roof financing is available, and gives you the flexibility to protect your home now and pay over time.

- At Rockland Builders, we offer financing solutions that are made for real-life budgets. Whether you’re looking for short-term 0% interest for 12 months or prefer a longer-term option that extends up to 120 months with fixed monthly payments, we’ve got you covered. Our goal is to give homeowners flexible paths to quality roof ownership without the stress. We’ll help you pick the best option for your roofing project and make sure it fits your needs and timeline.

Why You Might Need Roof Financing

Replacing a roof isn’t always planned. Whether your insurance company denied your claim, only covered part of it, or you’re just ready to upgrade from shingles to metal, the bill can catch you off guard.

Here are a few reasons we see homeowners turn to roof financing:

- Their homeowners insurance policy didn’t fully cover the cost (especially for cosmetic or pre-existing issues)

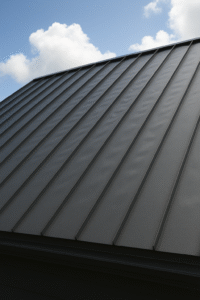

- They want to upgrade to premium materials like standing seam metal

- They need emergency roof repairs after a storm, and waiting isn’t an option

- It’s just time to replace their roof!

- They’d rather make low monthly payments than pay everything up front

No matter the reason, we believe every homeowner should have access to a reliable, long-lasting roof.

Roof Financing Options Through Rockland Builders

We’ve made the process of financing a new roof pretty simple. Rockland Builders offers two primary roof financing options that make it easier to move forward with your project:

- 12-Month, 0% Interest Plan

Perfect for those who want to spread out payments without paying extra in interest. This short-term option is ideal if you plan to pay it off within a year and want to avoid additional costs. - Extended Financing – Up to 120 Months

For larger roofing projects or tighter budgets, this longer-term option offers more breathing room with fixed monthly payments. You’ll know exactly what to expect, when, and we’ll help you choose a term that fits your financial goals.

Both of these options come with flexible terms, and we’re happy to walk you through what works best for your situation. Whether you’re replacing a storm-damaged shingle roof or investing in a new roof and metal panels, we’re here to make it doable.

Other Roof Financing Options to Consider

Depending on your situation, you might also want to explore:

- Personal loans – A quick and flexible way to borrow money for your roof replacement or roof repairs, often with fixed interest rates and fast approval.

- Home equity loans – If you’ve built up equity in your house, this option lets you borrow at a lower rate with predictable repayment terms.

- HELOCs (Home Equity Lines of Credit) – Ideal if you want more flexible borrowing over time instead of one lump sum.

- Government programs – Some federal housing administration and local grants offer help to low income homeowners or very low income homeowners.

- Credit unions and community banks – These often offer competitive interest rates to homeowners with good or excellent credit.

We’ve worked with homeowners who used all of the above: whatever works best for you, we’re here to help you coordinate.

What Roof Financing Typically Covers

Your financing plan can often be used to cover the full scope of your roofing project, including:

- Tear-off and disposal of your old roof

- Labor and installation

- Roofing materials like asphalt shingles or metal panels, including standing seam metal roofing

- Upgrades such as ice/water barrier or ridge ventilation

- Related projects like gutters, flashing, or insulation (when bundled)

How to Choose the Best Way to Finance a Roof

There’s no one-size-fits-all answer. Here are a few things we walk our clients through:

- Compare loan terms: Shorter loans mean less interest, but higher payments.

- Check your interest rate: A 0% offer can be great, but only if you’re confident you can pay it off on time.

- Understand your budget: What monthly payment can you comfortably manage?

- Review your credit score and debt to income ratio: These will determine what you qualify for and what rates you’ll be offered.

Our team is happy to talk through all of this with you, no pressure.

Common Questions About Roof Financing

How do most people pay for a roof?

It’s common to pay for a new roof with a loan of some kind, often a home equity loan or a HELOC. Many homeowners use a mix of insurance coverage, savings, and financing to complete the job.

What credit score do you need to finance a roof?

When financing a new roof, most lenders look for a score of 620+, but Rockland Builders’ programs can work with a variety of credit profiles.

What type of loan is best for a new roof?

That depends on your credit, equity, and budget. We’ll help you compare all options.

Can I get a roof loan with bad credit?

In many cases, yes. There are roofing company financing programs and lenders who specialize in helping poor credit borrowers.

Will financing delay my project?

Not with us. We make sure your loan is squared away fast, so your roof replacement stays on schedule.

How much a month to finance a roof?

It varies, but we’ll show you the math based on your budget and loan amount.

Next Steps

If you’re staring at a leaking ceiling or dreaming of a sleek new metal roof, don’t let cost keep you stuck. Here’s what to do:

- Get a free inspection and estimate from Rockland Builders

- Ask us about our roof financing options and available terms

- Choose the path that fits your needs—whether it’s 0% interest, long-term monthly payments, or partial financing to bridge the gap

Get A New Roof That’s Gentle On Your Checkbook – Call Rockland Today

No one gets excited about paying for a new roof. But when the storms hit or the shingles start curling, you want a solution that won’t wreck your finances.

At Rockland Builders, a roofing company in Kutztown, we make financing a new roof feel a little less daunting and a lot more doable. Whether you’re taking advantage of our 12-month 0% interest plan or stretching your budget with long-term financing up to 120 months, our options are straightforward.

Let’s make your new roof project simple, smart, and stress-free.

Give us a call, shoot us a message, or schedule your free estimate today. Let’s get you covered, financially and literally!